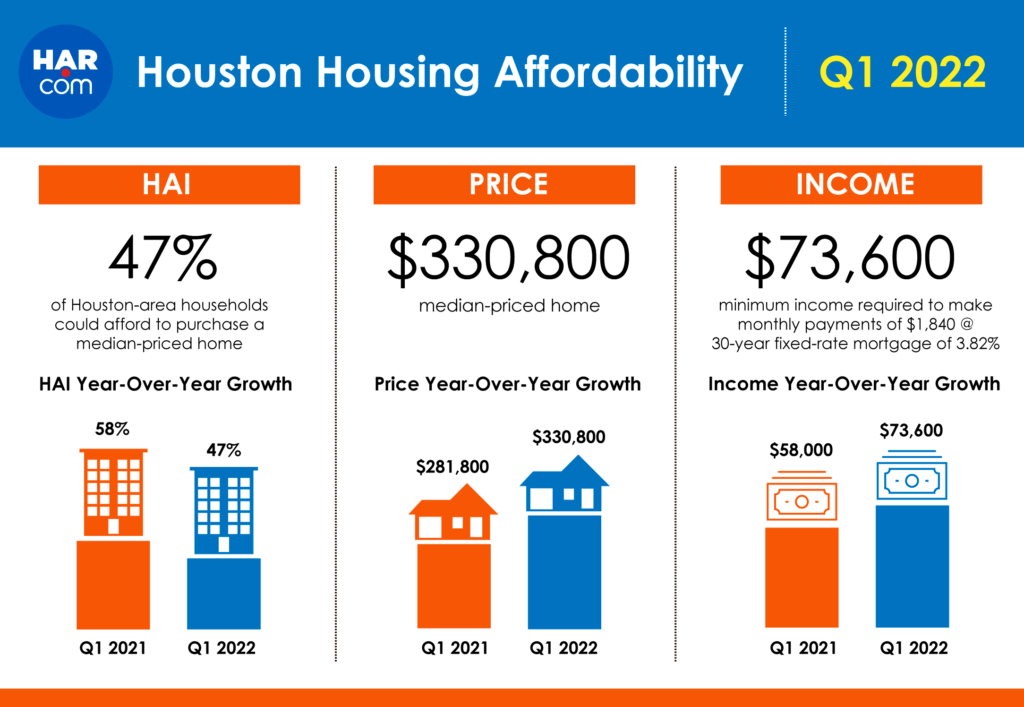

Fewer households throughout the Greater Houston area could afford to purchase the median-priced home in the first quarter of 2022, as home prices and mortgage interest rates climbed. Homebuyers in the Houston Area need 26.9 percent more income than they did a year ago to afford the median-priced home, according to the newly launched Houston Association of Realtors® (HAR) Housing Affordability Index.

HAR’s Housing Affordability Index measures the percentage of households that can afford to purchase a median-priced, single-family home for regions and select counties in Texas.

About half of all Houston-area households, 47 percent, earned the minimum annual income needed to purchase a $330,800 home in the first quarter of 2022. That’s down from 58 percent in the first quarter of 2021. The monthly payment, including taxes and insurance, on a 30-year, fixed-rate loan would be $1,840, assuming a 20 percent down payment and an effective composite first quarter interest rate of 3.82 percent.

The Houston Area was more affordable compared to the Austin and San Antonio metro areas, according to HAR’s Housing Affordability Index. The Dallas metro area had comparable affordability to the Houston Area for the first quarter of 2022. However, the analysis found all metro areas examined are less affordable today than they were a year ago. Households in Texas need to earn 29.8 percent more income than they did a year ago to afford a typical home. A household income of $73,200 was required to qualify for the purchase of a $328,990 statewide median-priced, single-family home in the first quarter of 2022.

Compared with Texas, 45 percent of the nation’s households could afford to purchase a $368,200 median-priced home, which required a minimum annual income of $74,400 to make monthly payments of $1,860. Nationwide affordability was down from 55 percent at this time last year.

“With rising home prices and mortgage interest rates at the top of most consumers’ minds, HAR felt compelled to provide an easy-to-understand measurement for gauging housing affordability,” said HAR Chair Jennifer Wauhob with Better Homes and Gardens Gary Greene. “We plan to produce these reports on a quarterly basis to help consumers make informed decisions about the home buying process.”

“The median price of a single-family home in Houston has increased nearly $80,000 in the last two years, and this makes it difficult for families to afford to buy a home,” said Patrick Jankowski, Senior Vice President of Research for the Greater Houston Partnership, who assisted with reviewing the data. “As home prices and interest rates continue to increase, we could see more people stay in rentals or multi-family units because they cannot afford to move, and some people are going to have to accept less house than they originally wanted to buy.”

The opportunity for Texans to buy a home was made more challenging by the lack of growth in the median income of households across the state. The chart below illustrates how the minimum household income needed to purchase a home changed year over year.

Minimum Qualifying Household Income

| Region | Q1-2022 | Q1-2021 | Change ($) | Change (%) |

| Austin Metro | $120,400 | $90,000 | $30,400 | 33.8% |

| Dallas Metro | $81,200 | $61,600 | $19,600 | 31.8% |

| Houston Metro | $73,600 | $58,000 | $15,600 | 26.9% |

| San Antonio Metro | $71,600 | $54,800 | $16,800 | 30.7% |

| Texas | $73,200 | $56,400 | $16,800 | 29.8% |

| U.S. | $74,400 | $58,800 | $15,600 | 26.5% |

Highlights from the first-quarter 2022 Housing Affordability report:

· Compared to the previous quarter, housing affordability declined in 14 tracked counties and improved in two counties (Matagorda County and Wharton County).

· Compared to the previous year, 14 counties saw a drop in housing affordability, one county remained unchanged (Matagorda County) and one county improved (Colorado County).

· The most affordable counties were Chambers County (56 percent), Colorado County (54 percent), and Wharton County (54 percent). In Chambers County, the minimum household income needed to qualify for a $316,495 home was $74,400.

· In Harris County, Memorial Villages, River Oaks, and West University Place were the least affordable. Purchasing a median-priced home in River Oaks required the highest minimum household income of $585,200. Only 2 percent of households in Harris County could afford to purchase the median-priced home in River Oaks.

· The Aldine Area was the most affordable in Harris County—54 percent of Harris County households made the minimum annual income of $58,800 to afford a median-priced home in the Aldine Area.

· In Fort Bend County, Stafford was the most affordable area—69 percent of Fort Bend County households were able to afford the median-priced home in Stafford based on the annual income. Fulshear was the least affordable (31 percent).

· In Montgomery County, Willis was the most affordable area—68 percent of Montgomery County households were able to afford the median-priced home in Willis based on the annual income. The Woodlands was the least affordable (33 percent).

· In Brazoria County, Angleton was the most affordable—69 percent of Brazoria County households were able to afford the median-priced home in Angleton based on the annual income. Manvel was the least affordable (29%).

· In Galveston County, La Marque was the most affordable—64 percent of Galveston County households were able to afford the median-priced home in La Marque based on the annual income. Bolivar Peninsula was the least affordable (31%).

· Fort Bend County required the highest minimum qualifying income in the Great Houston Area. A minimum annual income of $95,200 was needed to purchase a $380,000 home; 51 percent of households in Fort Bend County could afford to purchase the median-priced home.

For HAR’s full Housing Affordability report and data tables, please visit www.har.com.

Source: Houston Association of Realtors® (HAR)