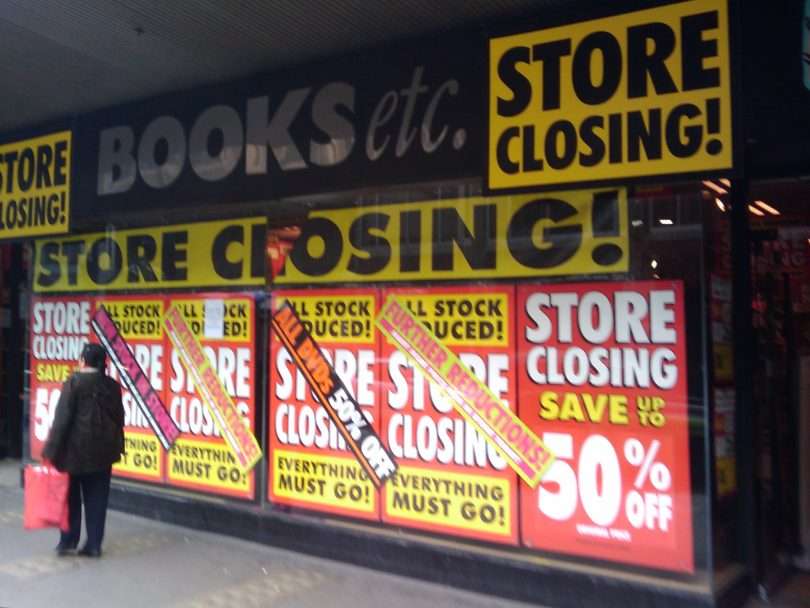

As Black Friday approaches, shoppers across the United States prepare for the holiday shopping rush against widespread retail closures. More than 2,000 stores are set to shut their doors by the end of 2024, with 13 major retail chains accounting for a total of 2,055 closures. The shakeup reflects a retail landscape grappling with changing consumer habits, financial pressures, and shifting strategies.

Family Dollar tops the list, closing at least 600 locations this year. The chain’s decision is part of a broader trend among large retailers reassessing their footprints to focus on profitability. While some, like Walmart and TJX (the parent company of T.J. Maxx and Marshalls), are also closing underperforming locations, they plan to open new stores in more lucrative markets.

Pharmacies have also seen significant reductions. CVS is in the final stages of its three-year plan to close 900 stores, citing demographic changes and new shopping patterns. Rite Aid has announced another 77 closures, adding to the 150 stores it shuttered last year as part of its bankruptcy restructuring. Walgreens, meanwhile, has announced plans to close 1,200 stores over the next three years, though those closures won’t begin until 2025.

The restaurant sector has not been spared. Denny’s plans to close 50 locations by the end of this year, targeting lower-volume locations. Another 100 restaurants are set to close in 2025.

Retail Closures Hit Communities Hard

The closures are being felt deeply in communities across the country. In the District of Columbia, Aurora Market, a family-owned and veteran-operated store in the Brookland neighborhood, recently announced its indefinite closure after being targeted by thieves in nearly a dozen incidents. The store served as a vital resource for underserved communities, and its closure reflects the difficulties smaller businesses face amid rising crime and economic pressures.

Larger retail chains have also faced challenges. Foot Locker closed 113 stores this year as part of a strategic overhaul, while Macy’s began a three-year plan to shut 150 stores, starting with 50 in 2024. Financially struggling brands like Express have closed 95 flagship locations and 12 UpWest-branded stores.

Advance Auto Parts, one of the nation’s leading automotive aftermarket retailers, announced it would shutter more than 700 stores as part of a broader plan to improve profitability. Other chains, like LL Flooring, formerly Lumber Liquidators, are going out of business entirely, with the company holding liquidation sales for its remaining 200 stores before shutting down.

The Future of Retail

Experts predict the pace of closures will continue. UBS analysts estimate that as many as 45,000 stores could close across the U.S. over the next five years, driven primarily by the collapse of smaller businesses. Even as retail giants like Costco, Target, and Home Depot expand, many retailers are scaling back due to shifting consumer preferences and financial pressures.

7-Eleven’s parent company, Seven & I Holdings Co., announced it would close 444 North American locations, citing underperformance. Declining tobacco sales, bans on flavored nicotine products, and reductions in SNAP benefits affected the company’s profitability.

For many communities, the loss of retail options goes beyond inconvenience. In urban neighborhoods like D.C.’s Brookland, closures leave gaps in access to essential goods and services while also impacting the sense of connection and identity that local businesses foster.

As shoppers prepare for Black Friday, the closures serve as a reminder of the ongoing transformations within the retail industry. A veteran store owner reflected on the challenges, saying, “Stores like ours aren’t just businesses—they’re part of the community fabric. When they close, it leaves a void that’s hard to fill.”

By: Stacy M. Brown, NNPA Newswire