60% of Americans Say Their Network Opens Doors to Moneymaking

Many Americans see the power of personal connections as a key to unlocking moneymaking opportunities.

Many Americans see the power of personal connections as a key to unlocking moneymaking opportunities.

A new survey suggests that while consumers are decreasing their spending to get by in the current economy, they harbor some anxieties and are struggling to improve their approach to money management.

Research shows that Americans associate pet ownership with positive money habits.

It’s critical to understand the ins and outs of borrowing for college before taking out a loan.

Check out these five money-saving strategies that can help you beat inflation.

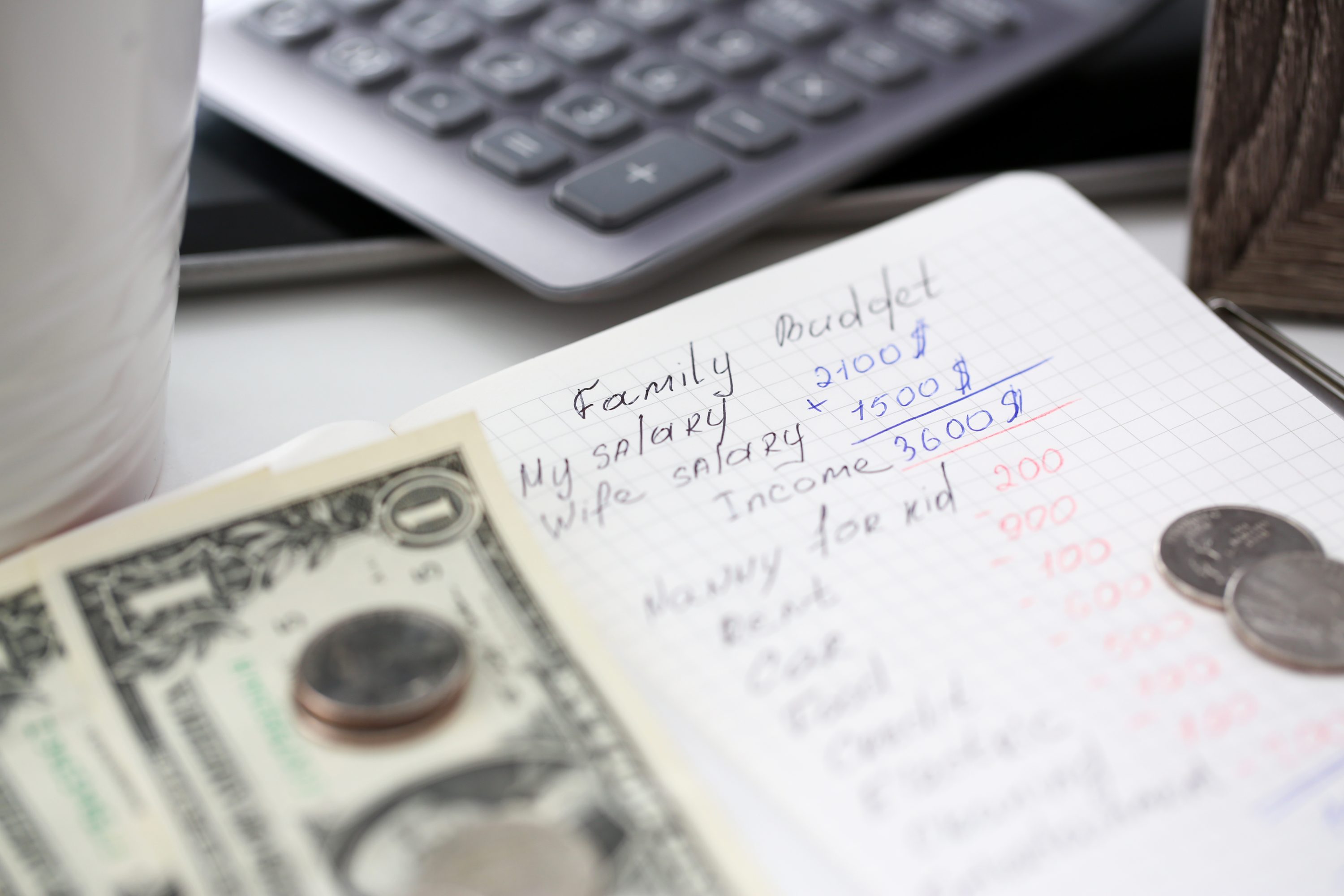

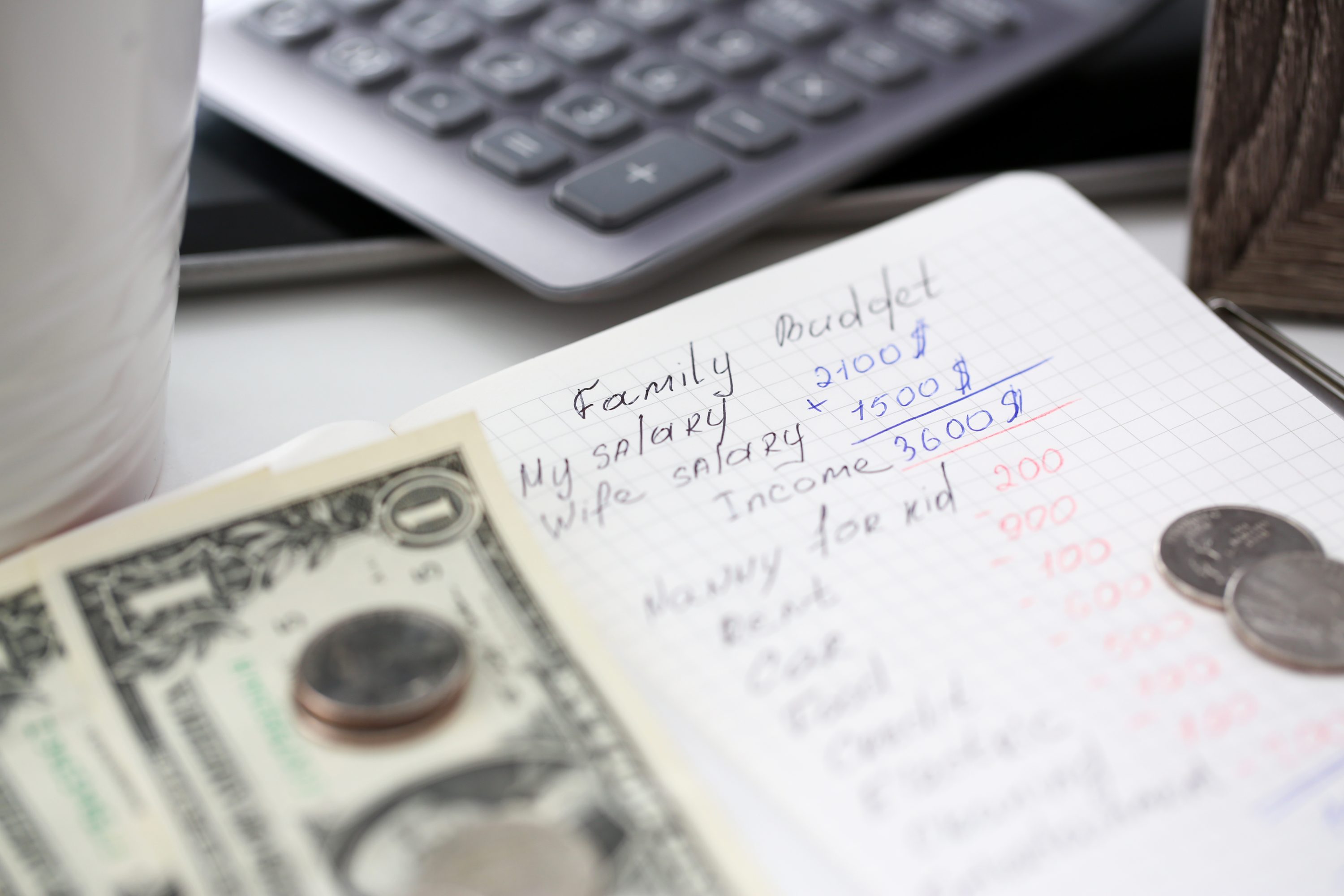

The inaugural “Wells Fargo Money Study” surveyed American adults and teens to uncover candid truths about their current finances, money stories, personal goals and other issues related to their attitudes toward money.

In observance of National Financial Literacy Awareness Month, Mason Makes Money Fund will be hosting several in-person and virtual events taking place throughout the month of April.

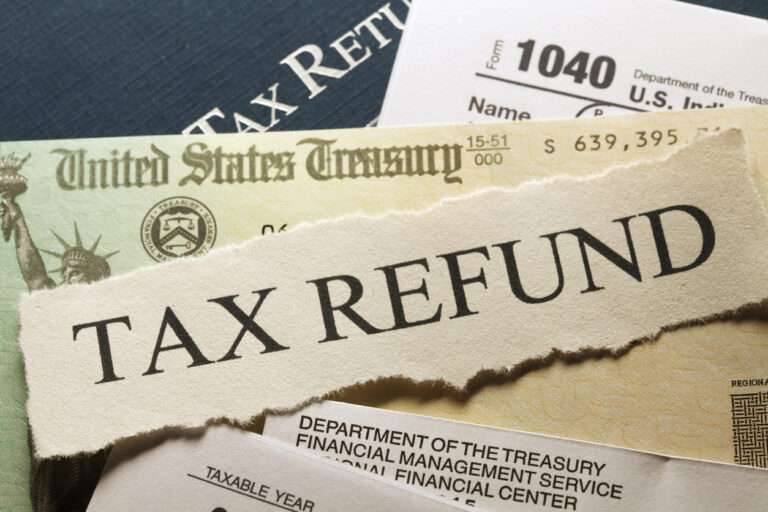

Here are key findings that shed light on American attitudes about taxes and their refunds.

While your path to building wealth should be tailored to your circumstances, this three-pronged approach can help you plan for a stable financial future.

Michael Liersch, head of Advice and Planning at Wells Fargo’s Wealth & Investment Management division, stresses the need to foster open conversations about financial decision-making.

While contributing to a worthwhile cause is a common aspiration, actually doing so right now may feel unrealistic if you’re struggling with your own finances.

With many facing rising costs on essential needs, people are looking for deals and new ways to save money, now more than ever. As we enter the holiday season, what is meant to be a joyful time can become stressful – especially if money is tight! Luckily, it’s possible for everyone to enjoy the holidays…

By d-mars.com News Provider The COVID-19 pandemic has underscored the importance of having access to safe, reliable, and affordable medications. This is especially critical for Americans with underlying medical conditions who struggle to afford medications. To offset rising drug costs, many Americans import pharmaceutical drugs from Canada and other international pharmacies. According to the Campaign…

By d-mars.com News Provider While there are many ways to set your kids up for a successful future, money in the bank is one of the most powerful financial tools you can pass along. Every dollar you save or invest can help your child create a productive and stable foundation for many years to come….

by d-mars.com News Provider While the past year has been rough in so many ways, one positive result is that people are focusing more on saving money — creating a silver lining to the cloud that was 2020. A new survey from Coinstar found nearly 3 out of 4 people (74%) say they are likely…

by d-mars.com News Provider Is your money management a streamlined process? If you’re like many Americans, you may be spending more time than you’d like to be. Americans average spending seven hours per month managing their finances, according to a new online survey among more than 2.000 U.S. adults by The Harris Poll on behalf…

by d-mars.com News Provider Each year, approximately 200,000 men and women transition from the U.S. military to civilian life.1 It can be a dramatic life change with financial implications that many people don’t realize or plan for. Much attention is given to accessing healthcare, transitioning careers and pursuing educational opportunities, but the adjustments to your…

By d-mars.com News Provider It’s an unfortunate case of cause and effect: As temperatures drop, thermostats go up, along with your utility bill. Homeowners nationwide know that it can be expensive to keep a home comfortable during cold weather. What’s more, with the whole family at home working and studying remotely, you’re probably using more…

By d-mars.com News Provider If you’re using a credit card, did you know there could be added perks right at your fingertips that could help you unlock even more value from your purchases? Here are some quick tips to help you take advantage of all the benefits and tools from your credit cards, so you’re…

Saving money is a top priority for many Americans, but it becomes even more important during times of economic turmoil. Luckily, there are many simple steps you can take to eliminate wasteful spending in your daily life. Here are eight easy strategies to start saving more money now: Track your personal expenses in…