Ten California and seven Washington, D.C., agencies are set to receive a substantial boost in funding totaling nearly $11 million, aimed at expanding housing counseling services for underserved communities. Among the beneficiaries in California are A-1 Community Housing Services in Hayward, the Rural Community Assistance Corporation in Sacramento, and the San Francisco Housing Development Corporation in the Bay Area. Those in D.C., are Housing Counseling Services, Lydia’s House in Southeast, the National Coalition for Asian Pacific American Community Development, the National Community Reinvestment Coalition, the National Foundation for Credit Counseling, Neighborhood Reinvestment Corp., dba NeighborWorks America, and UnidosUS.

Agencies in Alabama, Arkansas, Colorado, Florida, Georgia, and other states will also receive millions in funds as Vice President Kamala Harris and HUD Acting Secretary Adrianne Todman announced that the Biden-Harris Administration will allocate almost $40 million to broaden comprehensive housing counseling services nationwide. The funds, administered through the U.S. Department of Housing and Urban Development’s (HUD) Office of Housing Counseling, will facilitate counseling services catering to the needs of homebuyers, homeowners, and renters across America.

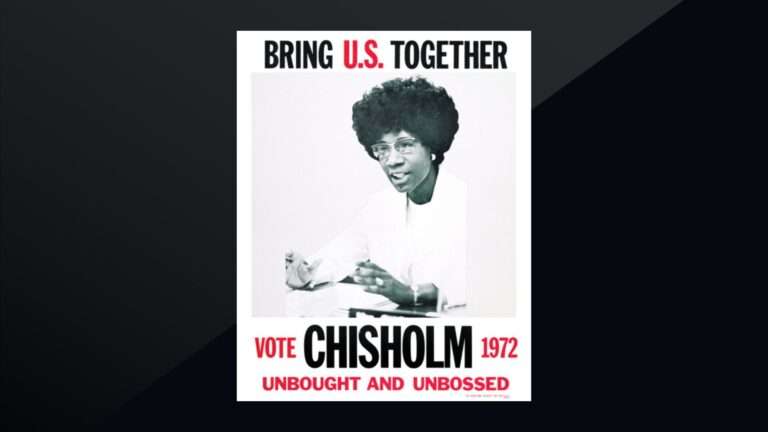

During a stop in Milwaukee, Wisconsin, which marked the third leg of the Vice President’s nationwide Economic Opportunity Tour, Harris emphasized the significance of homeownership beyond mere shelter. “Homeownership represents more than just a roof over our heads,” she stated. “It represents financial security, the opportunity to build wealth and equity, and a foundation for a better future for ourselves, our children, and future generations.”

Todman echoed Harris’s comments, highlighting the administration’s commitment to addressing housing barriers and closing the racial homeownership gap. Todman emphasized the pivotal role of HUD-approved housing counseling agencies, which served nearly one million Americans last year alone, providing crucial advice on financial literacy, home maintenance, and foreclosure prevention.

“This past year, HUD-approved housing counseling agencies reached almost one million Americans, providing them with invaluable advice on important topics like financial literacy, maintaining a home, and avoiding foreclosure,” Todman asserted.

The awarded grants are poised to benefit more than 165 housing counseling agencies and intermediary organizations. Notably, fourteen grantees will collaborate with 60 historically Black colleges and universities and minority-serving institutions to support new homeowners of color and other marginalized communities.

The White House said the allocated funds will bolster counseling services covering various topics, including financial management, homeownership, and affordable rental housing. For instance, UnidosUS aims to pave pathways for Latino homebuyers to enhance credit, access down payment assistance programs, and secure sustainable mortgage loans.

In Wisconsin alone, HUD estimates that over $300,000 of the new funding will aid consumers, with nearly 35,000 Americans already assisted by the program, 19,000 of whom reside in Milwaukee.

Officials said those counseling services, currently serving nearly 12,000 families in Wisconsin, including 40 percent Black families, play a crucial role in navigating housing challenges amid rising costs and limited inventory.

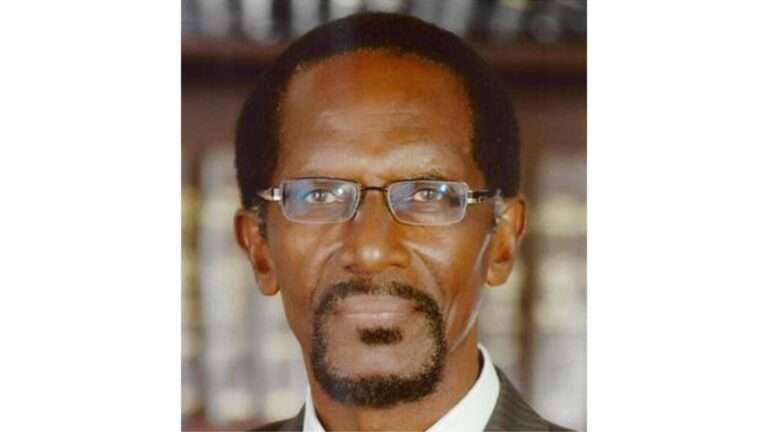

Deputy Assistant Secretary for Housing Counseling, David Berenbaum, emphasized the essential role of HUD-certified housing counselors as the first point of contact for those seeking housing support.

He said since 2020, HUD has been at the forefront of supporting housing counseling initiatives, aiding over 3 million individuals and families to obtain, sustain, and retain their homes. Berenbaum added that HUD’s ongoing initiatives, such as the introduction of programs aimed at historically underserved communities and the distribution of grants to bolster housing counseling services nationwide, underscore its commitment to extending housing counseling.

“Given the rising costs of housing, coupled with limited available inventory, housing counseling is a critical resource for homebuyers and renters seeking to navigate challenging processes and decisions,” he said.

By: Stacy M. Brown, NNPA Newswire Senior National Correspondent